Why I love my credit cards...but manage them carefully

/

I got my first credit card when I was 18 years old. My mom (a banker at the time) encouraged me to build my credit early, to give myself a strong record for when I needed it later on. But I had heard way too many stories of people getting in over their heads and helplessly watching the debt pile up. I was determined to not let that happen to me, so I buried the card in my desk drawer and only carried around my debit card. I felt like such a responsible, smart young man.

Credit cards tend to evoke one of two reactions from people:

- I just got out of credit card debt and I'm lucky to be alive!

- I love my credit cards! I flew to Timbuktu for free last year!

On the one hand, there are very few faster ways to dig yourself into a black hole of debt with outrageously high interest rates. On the other hand, if you can manage your credit cards carefully you can get fantastic returns on everyday purchases that can save real money (or earn you that flight to Timbuktu, if you want).

It wasn't until I left college that I first heard about reward cards. Some were offering $250 just for signing up? I was skeptical, to say the least. What was the catch? But as a newly minted finance major, I decided to take a closer look at the potential benefits.

At the time, my top expenses were groceries, gas, dining out, and the occasional splurge on new clothes. I was lucky enough to find a card that offered 6% cash back on groceries and gas and 3% at department stores. That covered 3 of my top 4 expense categories! I ran the math (like all good finance majors would) and discovered that if I just maintained my spending, I could earn hundreds of cash back dollars per year (which blew away the $95 annual fee).

I decided to give it a try, while watching my balance like a hawk. It turned out as long as I stuck to my original spending plan, there was no catch; I was saving money on every purchase.

Over time I have acquired a portfolio of credit cards that fit my lifestyle and spending patterns. Although some of them charge annual fees, I always run the math to make sure that my normal spending is enough to justify the fee.

My credit card setup:

- 1 card for dining, travel, and online shopping

- 1 card for groceries, gas, and department stores

- 1 card for rotating categories

- My very first credit card from when I was 18 (one of the credit agency metrics is average age of accounts, so I plan to keep this card forever)

With this combination of cards, I am able to get a solid discount on over 90% of my daily purchases and earn thousand of dollars in cash back and free flights.

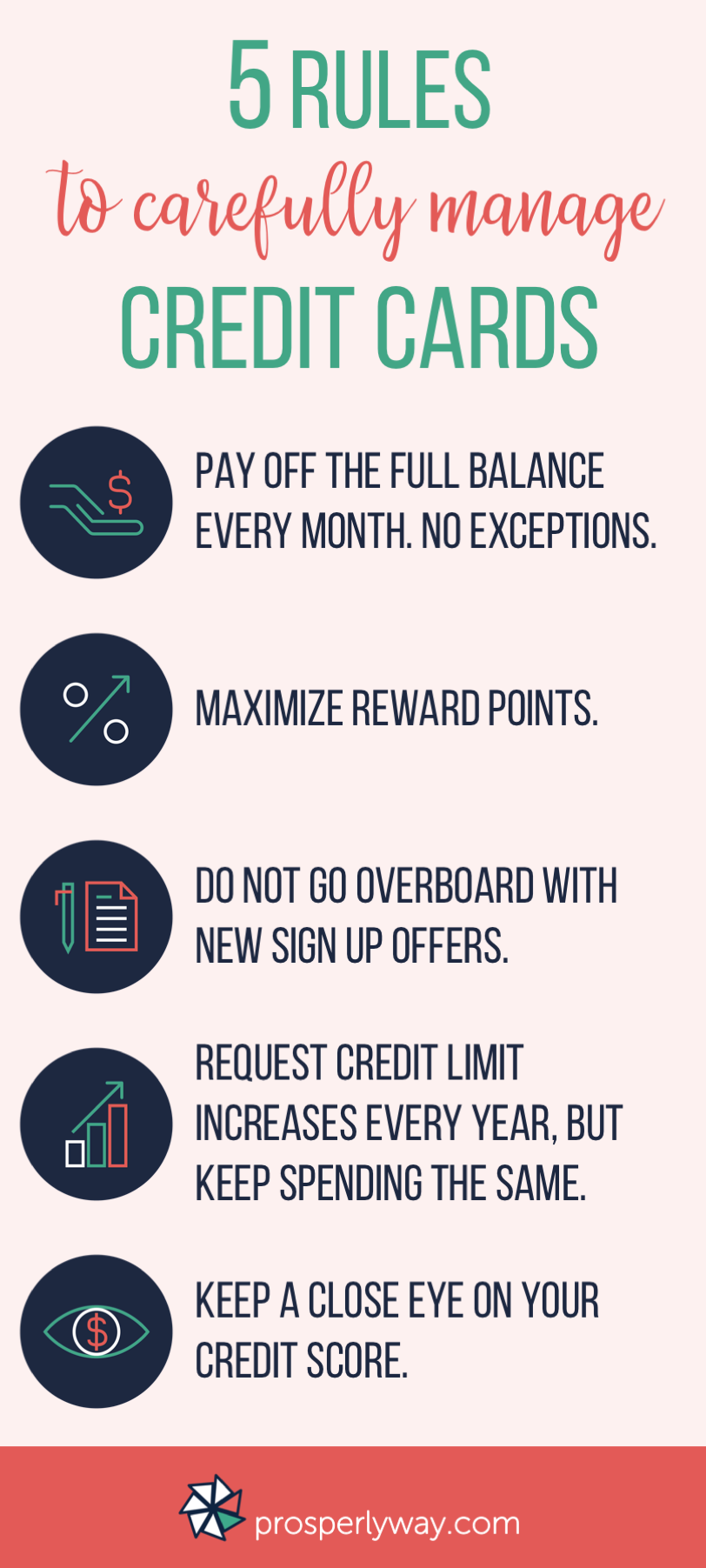

My 5 rules for managing credit cards carefully

1

Pay off the balance every single month. NO exceptions.

Failing to pay off your balance is a double whammy: your credit score takes a hit, and you pay exorbitant interest! It's easy to let it slip to next month. This is the number one mistake people make and the easiest way to get into serious debt.

Keep yourself honest by setting up automatic payments to ensure that you don't get in over your head.

2

Maximize your reward points

With my 4-card repertoire, I always have a preferred card for my daily purchases. If you stay on top of the categories, you can double or triple your rate of return.

Bonus tip: Shop online through your credit card company's shopping portal.

This is an amazing way to juice your points. Every time I make an online purchase, I first check my credit card portal to see if they offer bonus points at that particular store. If they do, all I have to do is click through their portal, which then re-directs back to the store. Continue with the purchase as I normally would, and then voila! I just earned a 5% discount (usually in the form of extra reward points on my next statement).

3

Do not go overboard with new sign up offers

It can be very tempting to jump at the 50,000 point offers. Don't fall for it. If you do this too much, you can crush your credit score and get on credit card companies' bad side. It's ok to take the plunge every so often when it makes sense, but I tend to be cautious.

As I referenced above, one of the metrics credit agencies use is average age of accounts. If you are constantly signing up for new credit cards just to get the sign up offer, you are shortening the average age. Don't do that.

4

Request credit limit increases every year

Another metric used by credit agencies is credit card utilization, which is your balance divided by your total credit limit. If you increase your limit every year, but keep your spending the same, you can automatically lower your credit utilization and improve your credit score. You might be surprised how much you can raise the limit if you just ask. But don't raise your spending along with it.

5

Keep a close eye on your credit score

If you are actively paying attention to your score, you are more likely to notice if it dips for some reason. It has the added benefit of making you more aware of how much you are using your credit card (similar to how using a dashboard tracker makes you more aware of your spending patterns).

Many banks have free credit score checks every month. Many folks still believe that checking your credit score makes your credit score go down. That's not necessarily true! Look around your bank's website to see if they offer a free check.

Here's my note of caution. All of the above assumes that you will be honest and keep yourself in check. If you know that you can't resist swiping your card (or I guess, inserting your chip nowadays) then don't knowingly push yourself into a trap. It's just not worth it for your long term goals.

And for those who love to swipe (err...insert): get a charge card. These cards require you to pay off the full balance every month, while still allowing you to earn a return on your purchases.

Do you have any other rules or ideas for managing your credit cards? I've found these to work well for me, but everybody is different!

Is Lasik surgery a good investment? I have (well, I had) terrible vision. When I'm not wearing my contacts or glasses, I can't tell how many fingers you're holding up from 3 feet away. Now I can see perfectly. The outcome has been miraculous. But is it a worthwhile financial investment?